ETFMG Video Game Tech ETF (GAMR)

Key Statistics

Thank you for reading this post, don't forget to subscribe!Minor Support Level 45.30 Minor Resistance Level 50.90

Major Support Level 28.45 Major Resistance Level 51.93

Minor Buy Signal 51.49 Minor Sell Signal 44.74

Major Buy Signal 55.42 Major Sell Signal 25.23

BRIEF OVERVIEW

In November 1972, a little known home computer company by the name of Atari, unknowingly established the video game industry by releasing Pong, the first commercially successful video game. Pong (along with Atari) became an overnight sensation, as it unleashed an exciting new pastime for teenagers and young adults.

By the late 1970s, video games had become a permanent fixture in mainstream America. Video game machines could be found in shopping malls, traditional storefronts, restaurants and convenience stores. In an attempt to grab a piece of the huge revenue stream, a horde of video game companies began to appear on the scene. The vast majority of these companies were bankrupt within the first few years of existence. However, a handful of the companies became household names. A small sample of names would include Nintendo, Electronic Arts, Sega Games, Magnavox and Midway Games.

By the early 1980s, new video games were being released on a weekly basis. In addition to Pong, the most popular games included Space Invaders, Pac-Man, Donkey Kong and Mario Bros. The video game industry had officially become a full blown mania, not only in the United States but also overseas, particularly in Japan. In fact, the mania had become so intense that several “mainstream” companies decided to enter the video game business. For example, Sears introduced a video game console designed specifically for home use. The brand name was Tele-Games.

Of course, all manias eventually implode. The video game industry was no exception. The peak occurred in 1982, with $8 billion in sales. Incredibly, the video game industry generated more revenue than the pop music industry ($4 billion) and Hollywood films ($3 billion), combined! Here’s another amazing statistic: Between 1978 and 1982, video game sales increased from $50 million to $8 billion, which represents an increase of 15,900% in four years. Without question, this was the true definition of a mania.

By 1983, video game companies had completely saturated the market with an oversupply of merchandise. The video game industry went into a complete tailspin. The bubble had officially burst. Over the course of the next two years, the majority of video game companies went bankrupt. Only a small number of well capitalized companies were able to survive.

By 1985, the industry was unrecognizable compared to the early 1980s. The popularity of video games had collapsed just as quickly as it had risen throughout the 1970s. To make matters worse, the video game industry was now facing stiff competition from personal computers. Families were replacing their video game consoles in favor of a home computer. After all, why would a family buy a video game console when it could purchase a home computer, which had the capability to do so much more?

The video game industry remained dead for the next 20 years. However, in the mid-2000s, the industry began to resurrect itself thanks to the Millennial generation. Video games became incredibly sophisticated and hi tech, as technology companies began to experiment with virtual reality. Today, the video game industry is enjoying a huge explosion in the number of users, very similar to the “glory days” of the 1970s.

In an effort to provide investors with exposure to the video game industry, the ETFMG family of exchange traded funds launched the Video Game Tech ETF on March 9, 2016. The ticker symbol is GAMR. This investment product is the world’s first ETF focused on the video game industry. GAMR includes 59 different holdings. The top five holdings include Capcom Co Ltd,

Micro-Star Intl, G5 Entertainment, Nintendo and Nexon Co Ltd.

SHORT-TERM VIEW – Video Game ETF GAMR

The recent volatility in the overall stock market has flipped the momentum in favor of the bears. The next level of support is 45.30. In order to recapture the momentum, the bulls need a weekly close above 50.90.

The most likely scenario is a continuation of lower prices. It’s always difficult to reverse the momentum. At least for now, the bears are in complete control of GAMR on a short-term basis.

LONG-TERM VIEW – Video Game ETF GAMR

Without question, the video game industry has enjoyed a dramatic resurgence in activity during the past 5 to 10 years. This huge explosion in popularity is being driven by Millennials, which includes anyone born between 1981 and 1996.

These days, video game enthusiasts are known as “gamers.” In terms of technology, today’s games are exponentially more sophisticated compared to the games in the 1970s and 1980s. More specifically, the most popular game is called League of Legends, in which players fight each other in a virtual arena. The developer of the game, Riot Games, claims that there are currently over 100 million regular players. These numbers are absolutely staggering, particularly when you consider the fact that this represents only one game among thousands of other games.

Of course, some experts claim that the gaming industry is setting itself up for another “boom bust” cycle similar to the 1980s. However, the consensus view suggests that today’s popularity within the gaming industry is quite different than the previous video game mania. For example, the current popularity within the gaming industry is more global in nature. As a result, there is a greater diversity among players. Additionally, in the early 1980s, the video game industry was competing head-to-head with the recent introduction of personal computers. Today, the industry is not competing against computers. In fact, the video game industry is actually working in unison with the computer industry to build a better product.

How big is the video game industry? The most recent statistics indicate that total sales were $109 billion in 2016. This number is truly remarkable. Based on empirical research conducted by several trend analysis firms, overall revenue should continue to expand for the next 5 to 10 years. These conclusions are based on the fact that Millennials will soon pass Baby Boomers as the nation’s largest living adult generation. Therefore, it’s quite easy to build an argument that the gaming industry will remain strong for the next decade.

The long-term view of GAMR is very bullish. However, it must be noted that the ETF has only been in existence for two years. The bulls are in control of the momentum as long as GAMR stays above 28.45 on a weekly closing basis.

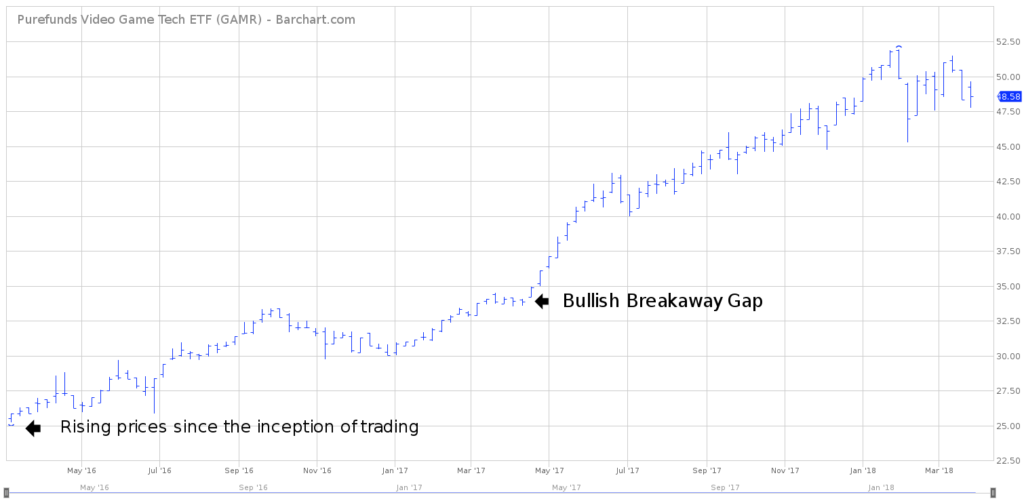

SHORT-TERM CHART – Video Game ETF GAMR

The short-term chart pattern recently turned bearish, as the broad stock market took a nasty tumble throughout the month of February. The next level of support is 45.30. The bulls need a weekly close above 50.90 in order to reverse the momentum.

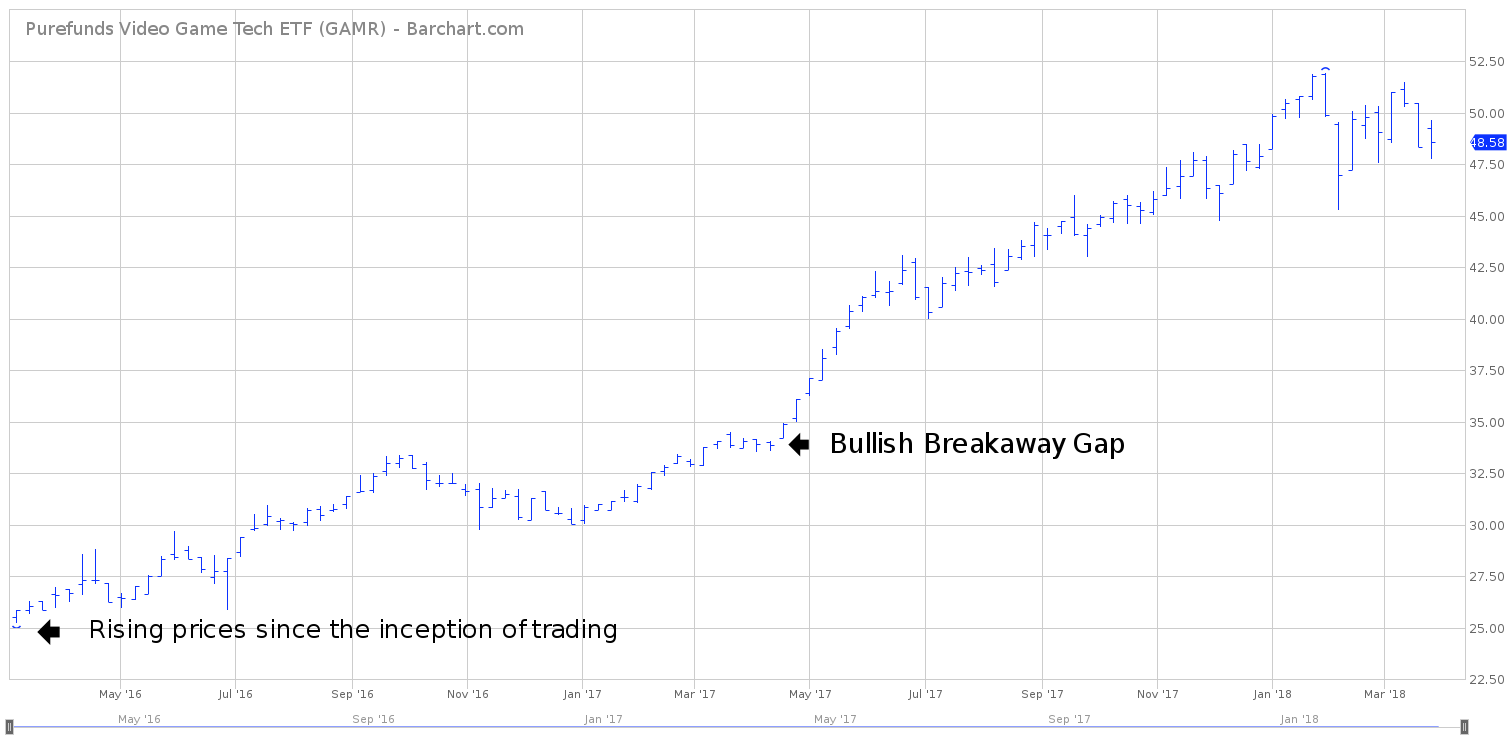

LONG-TERM CHART – Video Game ETF GAMR

GAMR only has two years of trading history. Therefore, it’s rather difficult to generate a long-term analysis. However, based on the available data, the chart pattern is extremely bullish. Essentially, GAMR has been moving higher since its inception date on March 9, 2016.

The ETF generated a very bullish “breakaway gap” during the week of July 11, 2016. At least for now, the path of least resistance is to the upside.