SPDR S&P 500 ETF (SPY)

Key Statistics

Thank you for reading this post, don't forget to subscribe!Minor Support Level 256.60 Minor Resistance Level 280.41

Major Support Level 107.43 Major Resistance Level 304.62

Minor Buy Signal 281.84 Minor Sell Signal 254.67

Major Buy Signal 308.45 Major Sell Signal 101.13

BRIEF OVERVIEW – S&P 500 ETF SPY

Stock market investors can be divided into two main categories, individual investors and institutional investors. Without question, the most popular stock market index among individual investors is the Dow Jones Industrial Average, which is comprised of 30 different companies. This index has been in existence since 1896 and it is beloved by stock market enthusiasts all across the world.

In terms of institutional investors, the Standard & Poor’s 500 is the most widely followed index. More commonly known as the S&P 500, institutional investors use the index as a measuring device to compare their performance results against the performance of the S&P 500. Consequently, the index is critically important among the institutional crowd. In fact, the annual performance of the S&P 500 has been known to “make or break” the trading careers of many Wall Street professionals. In an effort to gain a better understanding of this important stock index, let’s take a closer look at the S&P 500.

Before we dive into the specific details, perhaps it would be a good idea to briefly discuss the role of an institutional investor. In a nutshell, an institutional investor is an organization that invests on behalf of its members. There are six types of institutional investors: hedge funds, commercial banks, pension funds, mutual funds, insurance companies and pension funds. If you own a mutual fund, your account is being managed by an institutional investor.

Institutional investors are easily the largest participants in the securities markets in terms of trading volume. They perform the majority of the trades on major exchanges and greatly influence the prices of securities. Without institutional investors, the financial markets would be extremely illiquid and inefficient.

Let’s return our focus to the S&P 500. The launch date for the S&P 500 was March 4, 1957. There were similar versions of the index prior to 1957. However, the index did not include 500 companies until March 4, 1957.

The S&P 500 is divided into 11 different sectors. Each sector is subdivided into various industries which are designed to provide a representation of the US economy. Please review the following tables.

S&P 500 Stock Market Index

Sectors And Industries

Sector Industry

Consumer Discretionary Auto Components

Consumer Discretionary Automobiles

Consumer Discretionary Distributors

Consumer Discretionary Diversified Consumer Services

Consumer Discretionary Hotels, Restaurants & Leisure

Consumer Discretionary Household Durables

Consumer Discretionary Internet & Catalogue Retail

Consumer Discretionary Leisure Products

Consumer Discretionary Media

Consumer Discretionary Multiline Retail

Consumer Discretionary Specialty Retail

Consumer Discretionary Textiles, Apparel & Luxury Goods

Consumer Staples Beverages

Consumer Staples Food & Staples Retailing

Consumer Staples Food Products

Consumer Staples Household Products

Consumer Staples Personal Products

Consumer Staples Tobacco

S&P 500 Stock Market Index

Sectors And Industries

Sector Industry

Energy Energy Equipment & Services

Energy Oil, Gas & Consumable Fuels

Financials Banks

Financials Capital Markets

Financials Consumer Finance

Financials Diversified Financial Services

Financials Insurance

Financials Mortgage REITs

Financials Thrifts & Mortgage Finance

Health Care Biotechnology

Health Care Health Care Equipment & Supplies

Health Care Health Care Providers & Services

Health Care Health Care Technology

Health Care Life Sciences Tools & Services

Health Care Pharmaceuticals

S&P 500 Stock Market Index

Sectors And Industries

Sector Industry

Industrials Aerospace & Defense

Industrials Air Freight & Logistics

Industrials Airlines

Industrials Building Products

Industrials Commercial Services & Supplies

Industrials Construction & Engineering

Industrials Electrical Equipment

Industrials Industrial Conglomerates

Industrials Machinery

Industrials Marine

Industrials Professional Services

Industrials Road & Rail

Industrials Trading Companies & Distributors

Industrials Transportation Infrastructure

S&P 500 Stock Market Index

Sectors And Industries

Sector Industry

Information Technology Communications Equipment

Information Technology Electronic Equipment, Instruments & Components

Information Technology Internet Software & Services

Information Technology IT Services

Information Technology Semiconductors & Semiconductor Equipment

Information Technology Software

Information Technology Technology Hardware, Storage & Peripherals

Materials Chemicals

Materials Construction Materials

Materials Containers & Packaging

Materials Metals & Mining

Materials Paper & Forest Products

Real Estate Equity Real Estate Investment Trusts

Real Estate Real Estate Management & Development

S&P 500 Stock Market Index

Sectors And Industries

Sector Industry

Telecommunication Services Diversified Telecommunication Services

Telecommunication Services Wireless Telecommunication Services

Utilities Electric Utilities

Utilities Gas Utilities

Utilities Independent Power & Renewable Electricity Producers

Utilities Multi-Utilities

Utilities Water Utilities

As you can see, the S&P 500 is an excellent representation of the overall domestic economy. All major sectors and industries are covered. This explains why most institutional investors prefer the S&P 500 over the Dow Jones Industrial Average.

In regard to ETFs, the SPDR family of exchange traded funds introduced the S&P 500 ETF on January 22, 1993. The ticker symbol is SPY. This ETF is historically significant because it was the very first exchange traded fund listed in the United States. SPY is easily the most heavily traded ETF, with daily volume usually exceeding 100 million shares.

SHORT-TERM VIEW – S&P 500 ETF SPY

Instead of examining the short-term view of SPY, let’s focus our attention on reviewing the individual sectors within SPY. Please review the following table.

SPDR S&P 500 ETF

SHORT-TERM VIEW

Sector Six-Month Rate of Return

Information Technology 14.11%

Consumer Discretionary 13.81%

Energy 9.98%

Materials 2.40%

Industrials 2.21%

Health Care 1.79%

Financials (1.02%)

Real Estate (3.58%)

Telecom Services (8.28%)

Consumer Staples (9.63%)

Utilities (11.16%)

By examining the results of the various sectors, we can conclude that the massive bull market (which officially began in March 2009) could be in the early stages of rolling over into a bear market. Why? Because interest rate sensitive stocks have historically performed poorly near the end of a bull market cycle. Conversely, high tech stocks and consumer discretionary stocks usually generate superior returns as the bull market reaches its zenith. This is known as “sector rotation,” as investors move funds from one sector to another in an attempt to outperform the stock market averages.

As you can see from the table, consumer staples and utilities have been in a mini bear market for the past six months. Both of these sectors are definitely interest rate sensitive. Therefore, this could be an early warning sign that the equity bull market could be drawing to a conclusion.

At the opposite end of the spectrum, high tech stocks and consumer discretionary stocks are outperforming the S&P average. Typically, these are the types of stocks that perform best near the end of a bull market cycle.

LONG-TERM VIEW – S&P 500 ETF SPY

Let’s take a long-term view of the individual sectors in order to determine if the data is providing a potential sell signal (similar to the short-term sell signal). Please examine the following table.

SPDR S&P 500 ETF

LONG-TERM VIEW

Sector Five-Year Rate of Return

Information Technology 157.75%

Consumer Discretionary 101.79%

Health Care 79.47%

Financials 79.23%

Industrials 74.58%

Materials 55.23%

Utilities 33.06%

Real Estate 32.39%

Consumer Staples 28.70%

Telecom Services (2.25%)

Energy (2.46%)

By examining the data from the table, we can easily observe that the 5-year results are quite similar to the 6-month results. For example, Information Technology and Consumer Discretionary are the top two leaders among all sectors in both time frames. At the bottom of the list, we find that Utilities are ranked 7th and Consume Staples are ranked 9th.

If we add all of this information together, a strong argument could be made that the stock market (as measured by the S&P 500) could be near the end of its massive 9-year bull market. Of course, the stock market “perma-bulls” will argue that sector rotation (by itself) is not enough to signal the end of a bull market. Most likely, the perma-bulls are correct. It will take more than sector rotation to convince investors that a new bear market is underway. However, sector rotation should not be ignored. This could be an early warning sign that the tide is turning in favor of the bearish camp.

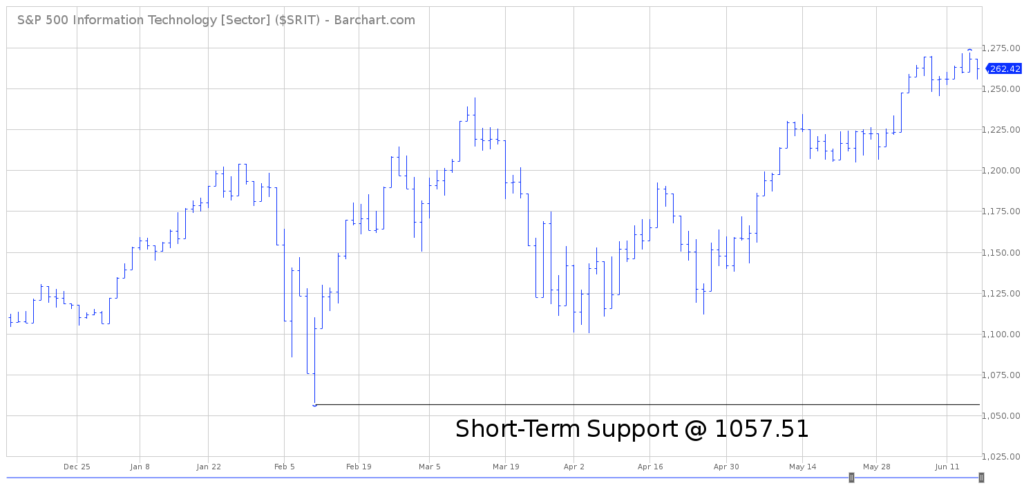

SHORT-TERM CHART – S&P 500 ETF SPY

Instead of analyzing a short-term chart of SPY, let’s examine the chart pattern for the Information Technology sector ($SRIT). The 6-month chart looks incredibly bullish. Of course, markets always look most bullish near the top. The first sign of trouble would be a weekly close below 1057.51.

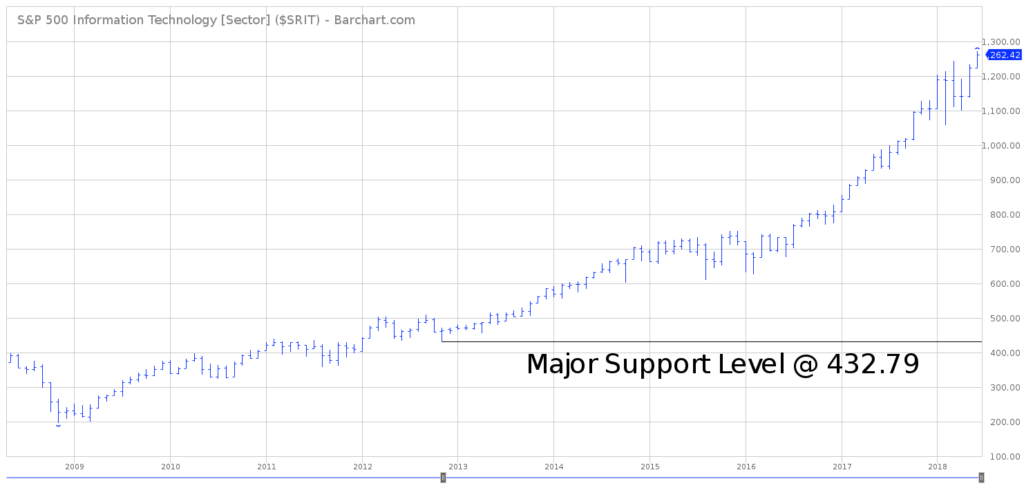

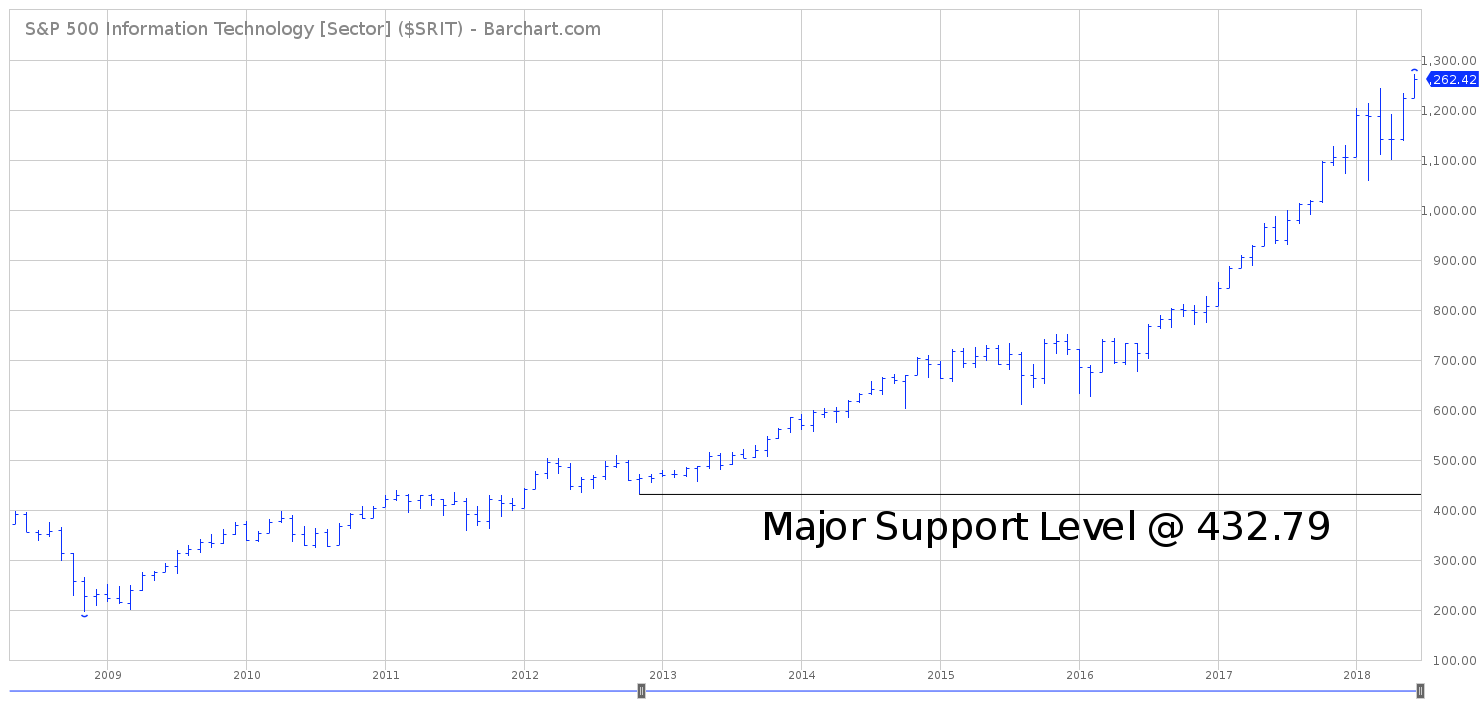

LONG-TERM CHART – S&P 500 ETF SPY

In terms of the long-term chart pattern, $SRIT is certainly in the bullish camp. Please examine the 10-year chart. It would take a weekly close below 432.79 to flip the chart from bullish to bearish.

Without question, investors are still pouring tons of money into the Information Technology sector of the S&P 500. However, when this sector begins to roll over, investors would be wise to pay attention. This could mark the “beginning of the end” of this historic bull market.